Roth 401k calculator 2021

Money goes in after taxes are paid which means that it wont reduce your annual taxable income. All of the gain is tax-free.

Roth Solo 401k Contributions My Solo 401k Financial

The IRS contribution limit increases along with the general cost-of-living increase due to inflation.

. The 5 year clock starts in the year for which the Roth solo 401k contribution was made eg. Individuals age 50 and over can also make an additional 1000 catch-up contribution from earned income for tax years 2021 and 2022. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation.

A Roth IRA and a 401k are two types of retirement accounts with one big difference in how they are taxed. A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. But you will not pay taxes on the amount when you.

Money goes in after taxes are paid. Mortgage Calculator Mortgage Payoff Calculator. ROTH IRA For the 2021 tax year.

With a Roth IRA contributions are made from money on which. Tax Refund Schedule Dates 2021 2022. A few other important notes.

This is the type of contribution that can be made as pre-taxtax-deferred or Roth deferral or a combination of both. Rollover IRA401K Rollover Options. 6000 or 7000 if you are over 50 years old.

An RMD is the amount of money andor assets that must be taken out by the beneficiary each year by December 31. For example in 2021 single individuals with a modified adjusted gross income MAGI of 140000 or more are ineligible to contribute to a Roth IRA as are couples filing jointly with a MAGI of 208000 or more. Additionally as the employer you can make a profit-sharing contribution up to 25 of your compensation from the business up to 58000 for tax year 2021 and the maximum 2022 solo 401k contribution is 61000.

The 2021 deferral limit for 401k plans was 19500 the 2022. However this account is different from a traditional IRA because you contribute after-tax money to it so in retirement you can withdraw your money tax-free. Roth IRA funds offer you tax-free growth and a range of withdrawal options but once again if.

Cashing out of your 401k is an incredibly risky choice that should only be made under extreme circumstances. Roth 401k contributions called a Designated Roth account. Contribution limits for 2021.

If you return the cash to your IRA within 3 years you will not owe the tax payment. Buy Car Calculator. Yes since you made the Roth solo 401k contribution for 2020 in 2021 by your business tax return plus timely filed business tax return extension.

You pay no tax when you withdraw it. Get details on IRA contribution limits deadlines. As an investor-owner you own the funds that own Vanguard.

Just a little bit short of your retirement savings goal. Best Tax Software For The Self-Employed 2021-2022 Tax Brackets Tax Calculator Cryptocurrency Tax Calculator. The New HR Block Tax Calculator.

He deferred 19500 in regular elective deferrals plus 6500 in catch-up. For the 10-year period ended December 31 2021 7 of 7 Vanguard money market funds 67 of 86 Vanguard bond funds 21 of 24 Vanguard balanced funds and 128 of 183 Vanguard stock fundsfor a total of 223 of 300 Vanguard fundsoutperformed their Lipper peer group averages. 1 This should be a rate that youve determined best represents the rate that the converted amount will be taxed at.

Distributions must be taken either for your lifetime or on a schedule that would deplete the account within a specified number of years since the original owners death. If youre under age 50 you can contribute up to 6000. Roth IRA Calculator.

Salary Deferral Contribution In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can be contributed to a Solo 401k 2021 limits are 19500 and 26000 if age 50 or older. Total contributions to a participants account not counting catch-up contributions for those age 50 and over cannot exceed 61000 for 2022 57000 for 2020. The amount is increased to an adjusted gross income of 214000 up from 208000 in 2021.

In 2022 single filers with a MAGI of 144000 or more will be unable to. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

If youre age 50 or older you can contribute up to 7000. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. The tools and information on this webpage permit you to model scenarios of converting a traditional IRA to a Roth IRA based on information you specify about your age.

Roth IRA A Roth IRA is also a retirement account that you open and fund yourself not through an employer. If youre under age 50 you can contribute up to 6000. TRADITIONAL IRA For the 2021 tax year.

It shares certain similarities with a traditional 401k and a Roth IRA although there are important. In 2021 you can put up to 6000 into a Roth IRA and an extra 1000 catch-up contribution if youre age 50 or older. If you are not sure what your rate is or should be please consult a tax professional.

Limits could be lower based on your income. Try the H. Roth IRAs have the same contribution limits but also have income.

Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. For 2021 and 2022 6000 per year 7000 per year for those age 50 or older. 8 Sticking with our example above maxing out your Roth IRA and investing 6000 into your account brings your total retirement savings for the year to 9750.

The biggest benefit of a Roth 401k is that because youre paying taxes on your contributions now you can withdraw the money tax-free later. Take money out of an IRA. How to Rollover a 401K.

Moreover Roth IRAs are subject to income limitations. Effective February 1 st 2021 for members who are not enrolled in e-statements there will be a 300 monthly charge. Ben age 51 earned 50000 in W-2 wages from his S Corporation in 2020.

Investment Calculator Net Worth Calculator Home Buying and Selling. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Furthermore to qualify to make Roth IRA contributions filers must have earned income ie.

401K and other retirement plans. 2020 Roth solo 401k contributions made in 2021 start clock on 112020.

What Is The Best Roth Ira Calculator District Capital Management

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Roth Vs Traditional 401k Calculator Pensionmark

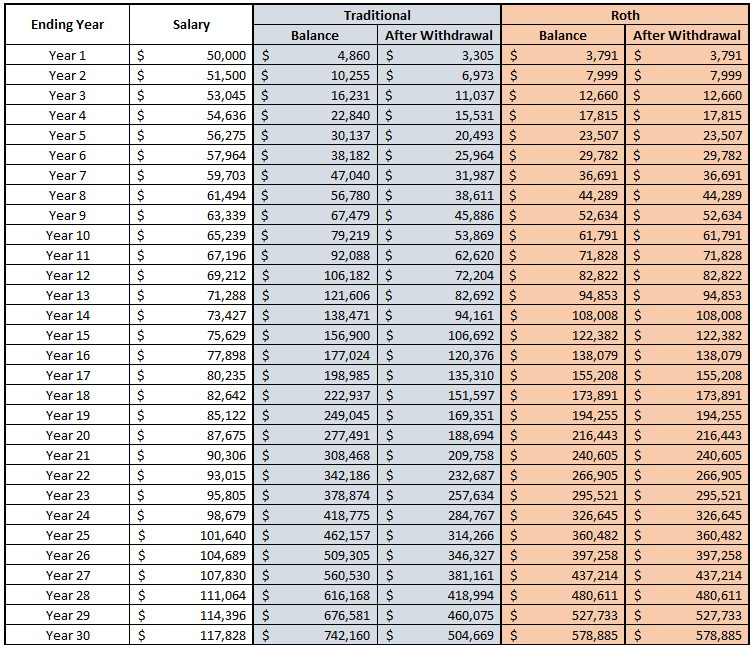

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Traditional 401 K Vs Roth 401 K Ubiquity

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Roth 401k Roth Vs Traditional 401k Fidelity

Roth 401k Might Make You Richer Millennial Money

Traditional 401 K Vs Roth 401 K Ubiquity

After Tax Contributions 2021 Blakely Walters

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

401k Calculator Paycheck Online 59 Off Www Ingeniovirtual Com

The Ultimate Roth 401 K Guide District Capital Management

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

The Maximum 401 K Contribution Limit For 2021

The Maximum 401k Contribution Limit Financial Samurai